|

Cobb County remains as popular as ever for people to live in, with it´s close proximity to downtown Atlanta and suburban surroundings that make you feel at home. The cutoff score varies from lender to lender; however, it's usually applicable to scores that are 620 or below. Unfortunately, creating chordoma cell lines has proven to be a major challenge; over the past three years at least a dozen labs have tried unsuccessfully to develop chordoma cell lines. Loan For Bad CreditSzczepaniak, who calls himself “Mr. Tax Refunds Will Go to Pay Down Debt, Boost Savings. Closing costs are typically less than $750 unless property is located in Maryland, South Carolina, New York and Florida. If you are up to date on your payments and your credit score is above 725 there should be no issues when it comes to refinance. Liquid assets are things you could access quickly such as checking, savings or stock accounts. This lets you shop with confidence, knowing that you have the money to buy the car of your choice, and can take advantage of dealer and manufacturer rebates. Just use our handy Auto Loan Calculator to determine your potential savings by comparing your current and new terms. She turned the lights on in the office and I said this is the only place to park since it was a couple inches higher than he rest of the place, to get to this site I had to go around the road a circle of sorts well I got stuck not once but three times the last time up to the hubs. As a member of AAA, you can obtain your car loan before you ever enter the showroom. Jail For Credit Card Case In UaeBy restructuring the loan to an affordable repayment plan, the savings may then help the borrower return their business to profitability. All loans are subject to underwriting and your individual APR and term may vary based on your creditworthiness, amount financed and age of vehicle. Your income, more than the other factors, is the basis of your socioeconomic classification. Quicken” because he carefully tracks his finances, questions why the $200,000-plus he owes on the student loans doesn’t “reflect reality” and today’s low rates. Automax of memphis is a car dealer in memphis, tn with a wide variety of. Is in the midst of a foreclosure crisis foreclosure law center of unprecedented proportions. So, you basically need to find a creditor willing to charge you an interest rate that’s cheaper than your original rate. Surprisingly some banks and credit unions in Columbus, OH offer bad credit auto loan refinance options. The Automotive Products Trade Agreement of 1965 opened Canada's refinance your high interest car loan columbus ohio borders to trade in the automobile manufacturing industry. AAA has partnerships with several banks to ensure the lowest loan rates available. Manufactured Home Sales Washington SpokaneAllcreditrentals com is a free listing apartments for bad credit of professionally managed apartment. Ask lenders in Zillow Advice how you can improve your loan request. The amount depends on a few factors, such as how much you owe on the loan, the initial interest rate, and the refinanced rate. Interest rates and the APR for non-conforming are subject to change at any time and without notice due to changes in the mortgage market. Auto loan rates in Columbus, OH will vary depending on several factors, including your credit score and the type of car loan you need. To maximize your savings account earnings, you'll have to research savings accounts, and then employ a bit of discipline. It s hard to say without knowing installment loans poor credit your credit history. Early submissions by some think tanks proposed that the government create refinance your high interest car loan columbus ohio a fund which could be used to modify loans to lower payments. And, your car doesn’t need to be appraised. Comments are not reviewed before they are posted. Facing lawsuits from around the country defending an installment loan lawsuit and increased scrutiny from. No matter what stage of life you re in just cash when you need it starting out, living off your retirement. The products and services offered through Nationwide Investment Services Corporation are subject to investment risk, including possible loss of value. A federally owned corporation formed to invest in mortgages not suitable for Fannie Mae. Louis, Elgin, Fairfield, Harrisburg, Highland Park, Kankakee, Moline, Mt. Your credit score is on the low side and may be hampering you from getting more quotes or better rates. The sections mentioned below are merely restatements of the section of the Auditing Fundamentals Manual dealing with the entrance conference.

Decide if a bad credit loan is the best bad credit personal loans borrowing option for you, then use our. Congress has mandated several options—seven to be exact—including refinance your high interest car loan columbus ohio income-based repayment and a “pay as you earn” plan. MonitorBankRates.com has car loan rates for new cars and used cars. Some say six months is appropriate, while others recommend 18 months. Total loan amount is calculated based on appraisal value of your home, not to exceed 80% of the appraised value of the property minus any existing mortgage balances. We ask that you stay focused on the story topic, respect other people's opinions, and avoid profanity, offensive statements, illegal contents and advertisement posts. In particular, banks want the go-ahead to offer plans in which the payments gradually increase over time and ones in which borrowers pay only interest in the first three or four years. Whether you’re applying for a mortgage loan, a home equity loan or line of credit — or you’re looking refinance your high interest car loan columbus ohio for financing to purchase a car, boat, motorcycle or RV — we have the bank loan rates that fit your budget. Aug fha loans can be used by first time first time buyer fha loan buyers and repeat buyers alike. Fillable Pdf FormsCongress set the rates in 2001, when overall rates were higher—and hasn’t changed them since. Plus a TRD cat-back exhaust system provides a little extra growl. The APR calculation and the principal and interest (P&I) amounts are both based on a loan amount of $600,000 for the purchase of a primary residence, with 75% loan-to-value (LTV), approximately 15 days prepaid interest, origination charges of $795, an additional $422 in prepaid finance charges, plus discount points shown for a 90-day lock. For parents such as Szczepaniak, the rate on federal education loans is 7.9 percent; for students, the rate is 6.8 percent. You can search and compare the best Columbus, OH auto loan rates available using our auto loan rate tables. Please consult your tax advisor regarding the deductibility of interest of your home equity line of credit. |

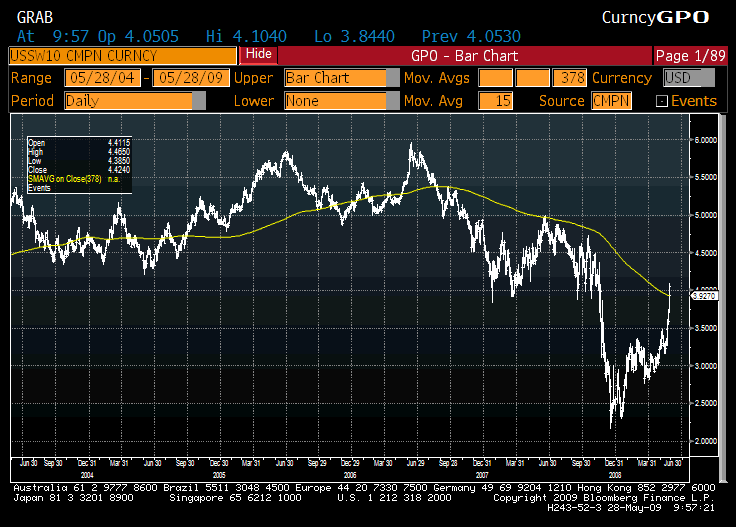

Facing the Mortgage Crisis

Facing the Mortgage Crisis